Therefore, variable costing is used instead to help management make product decisions. Now assume that 8,000 units are sold and 2,000 are still in finished goods inventory at the end of the year. The amount of the fixed overhead paid by the company is not totally expensed, because the number of units in ending inventory has increased. Eventually, the fixed overhead cost will be expensed when the inventory is sold in the next period. Figure 6.13 shows the cost to produce the 8,000 units of inventory that became cost of goods sold and the 2,000 units that remain in ending inventory. Additionally, when there is unsold inventory, absorption costing can result in higher reported profits because fixed overhead costs are deferred into inventory until the products are sold.

Another method of costing (known as direct costing or variable costing) does not assign the fixed manufacturing overhead costs to products. Therefore, direct costing is not acceptable for external financial and income tax accounting, but it can be valuable for managing the company. In absorption costing, the variable and fixed selling expenses are considered as period costs.

Step in using absorption costing are:

Absorbed overhead is manufacturing overhead that has been applied to products or other cost objects. The key costs assigned to products under an absorption costing system are noted below. Let’s walk through an example of absorption costing to illustrate how it works.

Due to fixed costs, an increase in output volume typically leads to lower unit costs, and a decrease in output typically results in a higher cost per unit. ABS costing will yield a more significant profit if the number of units produced exceeds the number of units sold. Direct costs and indirect costs are both included in the ABS costing components. This method of costing is appreciated by the generally accepted accounting principles (GAAP) fo valuing inventory and financial reporting. Absorption costing is normally used in the production industry here it helps the company to calculate the cost of products so that they could better calculate the price as well as control the costs of products.

Direct material cost percentage rate

Direct material, and direct labor, along with variable and fixed overhead expenses, are all part of the product costs under absorption costing. It not only includes the cost of materials and labor, but also both variable and fixed manufacturing overhead costs. This guide will show you what’s included, how to calculate it, and the advantages or disadvantages of using this accounting method.

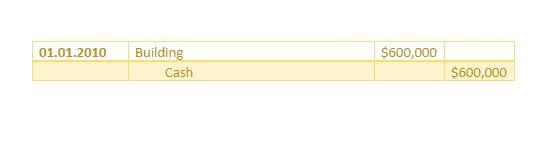

Therefore, ending inventory under absorption costingincludes $600 of fixed manufacturing overhead costs ($0.60 X 1,000units) and is valued at $600 more than under variable costing. Let’s say a company manufactures 10,000 units of a particular product with a cost per unit of $10 in direct materials, $8 in direct labor, and $2 in variable manufacturing costs. Let’s say the company also has fixed manufacturing overhead costs totaling $40,000 per year. If absorption costing is the method acceptable for financial reporting under GAAP, why would management prefer variable costing? Advocates of variable costing argue that the definition of fixed costs holds, and fixed manufacturing overhead costs will be incurred regardless of whether anything is actually produced. Using the absorption costing method on the income statement does not easily provide data for cost-volume-profit (CVP) computations.

AccountingTools

Unethical business managers can game the costing system by unfairly or unscrupulously influencing the outcome of the costing system’s reports. Expenses incurred to ensure the quality of the products being manufactured, such as inspections and testing, are included in the absorption cost. Under activity-based costing, it would then attempt to assign a proportion of that $20,000 to each unit it produces.

It is also used to calculate the profit margin on each unit of product and to determine the selling price of the product. The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead costs). As 8,000 widgets were sold, the total cost of goods sold is $56,000 ($7 total cost per unit × 8,000 widgets sold).