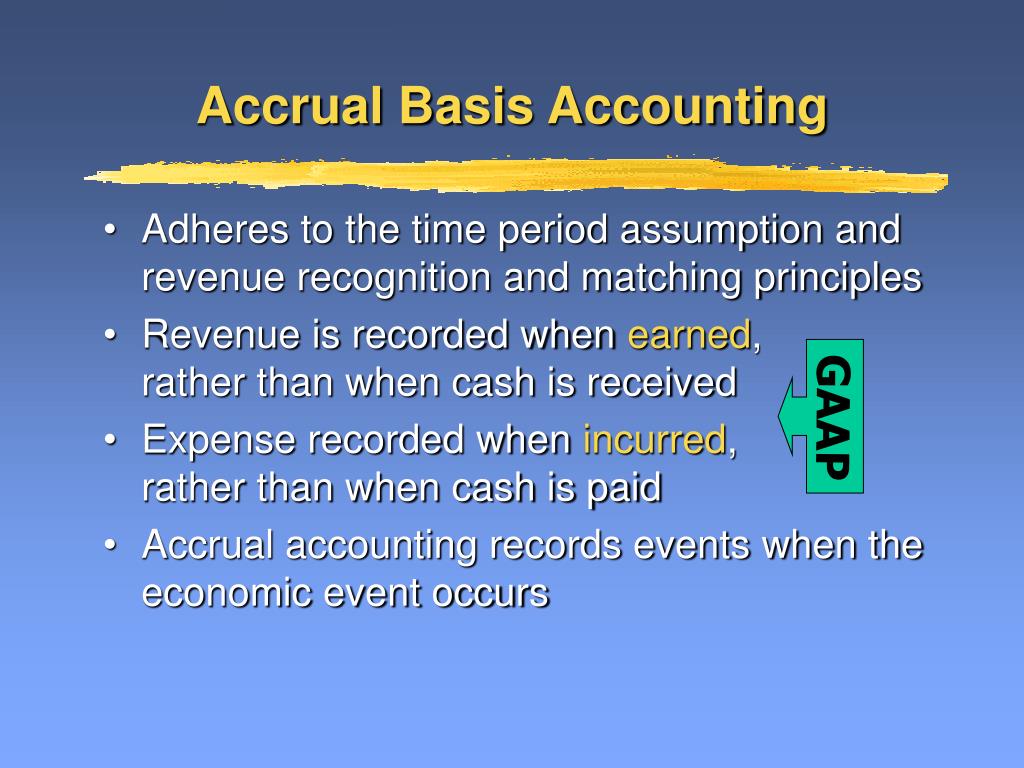

Accrual accounting is the preferred method according to generally accepted accounting principles (GAAP). It’s widely considered to provide a more accurate and comprehensive view of a company’s financial position and performance than the cash basis of accounting which only records transactions when cash is exchanged. Accrual accounting is an accounting method that records revenues and expenses before payments are received or issued. It records expenses when a transaction for the purchase of goods or services occurs. Accruals within a business are significant processes that help ensure the company’s financial statements properly reflect its financial health.

Ensures compliance with accounting standards

Accrual-based accounting is a popular method for big companies, as it uses the double-entry accounting method, which is more accurate and conforms with the generally accepted accounting principles (GAAP). The application of revenue recognition can vary significantly across industries, each with its own set of complexities. In the software industry, for example, companies often sell products bundled with maintenance and support services. Here, revenue must be allocated to each component based on its fair value and recognized over the period in which the services are provided. This method, known as the percentage-of-completion method, aligns revenue recognition with the delivery of services, offering a more precise reflection of the company’s performance.

Using accrual accounting in different businesses

One common approach is the “accrual by hours worked” method, where employees earn vacation time based on the number of hours they work. This method is beneficial for businesses with fluctuating work hours, as it aligns vacation accrual with actual time worked, ensuring fairness and transparency. In transactions between businesses, it is common for payment not to be made on the same date that an order is made or that goods are transferred. The performance of a business is assessed more accurately due to the application of the accrual concept.

Understanding Book Depreciation: Methods and Financial Impact

The key advantage of the cash method is its simplicity—it only accounts for cash paid or received. Managing vacation accrual becomes more intricate when employees take a leave of absence, as it can disrupt the standard accrual process. Whether the leave is for medical reasons, family commitments, or other personal matters, organizations must establish clear policies to address how such absences impact vacation accruals. These policies need to balance organizational requirements with employee rights, ensuring compliance with labor laws and fostering a supportive work environment. Efficiently managing vacation accrual is important for both employers and employees, as it affects financial planning and employee satisfaction.

- In accounting, the accrual concept is understood as journal entries, helpful at recognising expenses and revenues that are consumed or earned, respectively.

- Accrued expenses, also known as accrued liabilities, occur when a company incurs an expense it hasn’t yet been billed for.

- For example, let’s say a customer paid $100 for your consulting services in January, but you’ll only be providing the service in February.

Tax Law Change

There are a few points of difference between the accrual concept and the matching concept in the accounting process. For instance, a lender issues a specific amount of loan to a company and sends an invoice every month to the borrower with details of interest owed. The borrower, in such cases, can record interest expense in advance for the receipts, thus specifying its accrued interest. Suppose ABC Company, a service-based organisation, is working on a major project handled by PBC Company. As per conditions, the billing for this project will only be done after its completion.

Prepaid expenses

Cash accounting is more straightforward and simple, as organizations need to track only cash inflows and outflows. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. As mentioned, net income can be higher or lower than it otherwise would have been if only cash transactions were accounted for instead. It depends on the type of accrual and the effect it has on the company’s financial statements.

Without these rules, comparing financial statements among companies would be extremely difficult, even within the same industry. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

Accruals are the records of revenue and expenses that have been earned and incurred, but actual cash transactions are yet to occur. It involves non cash assets and liabilities that are recorded on the balance sheet. 2020 federal income tax deadline Accruals are important as they ensure accuracy in financial statements and reporting. Another example of an expense accrual involves employee bonuses that were earned in 2023 but won’t be paid until 2024.